In a historical budget of 2021 (for the year 2021-22), the government has announced that it will battle the pandemic with capital expenditure and not revenue expenditure, which shows that the intent is to create more wealth with the multiplier effect.

In the first budget after the pandemic that led to an economic slowdown across the world, the Finance Minister started the session by saying, “the preparation of this Budget was undertaken in circumstances like never before.”

For 2021-22, the FM has proposed a sharp increase in capital expenditure and has provided Rs. 5.54 lakh crores which is 34.5% more than the BE (Budget Estimate) of Rs 4.12 lakh crore for 2020-21. The capital expenditure, estimated in RE (Revised Estimate) is Rs. 4.39 lakh for 2020-21.

The fiscal deficit in RE 2020-21 is pegged at 9.5% of GDP. The government said that it will continue with the path of fiscal consolidation and intends to reach a fiscal deficit level below 4.5% of GDP by 2025-2026.

“We have funded this through government borrowings, multilateral borrowings, Small Saving Funds, and short-term borrowings,” the Finance Minister said.

The gross borrowing from the market for next year will be around Rs. 12 lakh crores.

Where Will the Govt Spend the Money?

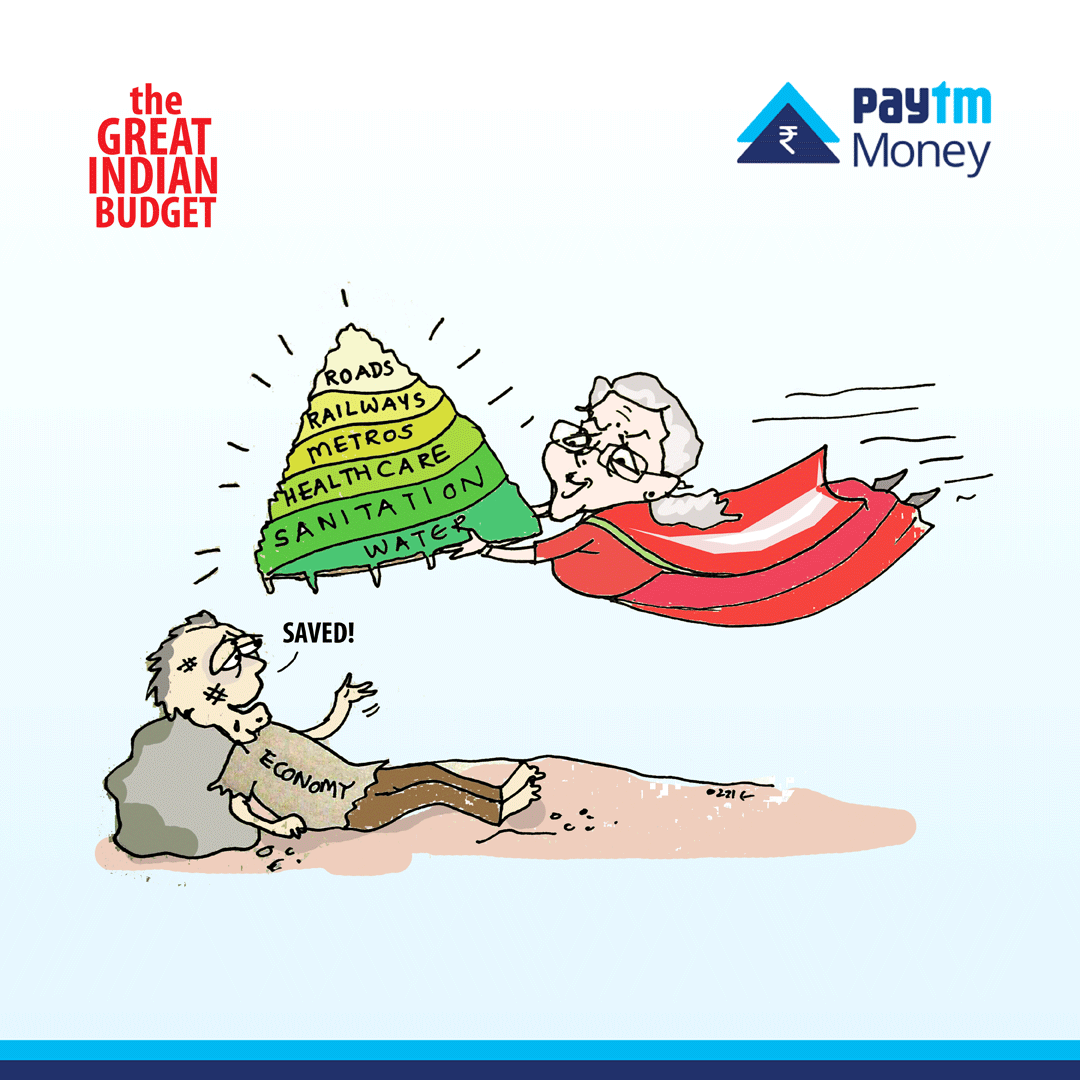

The government has proposed to spend a large chunk of the capital on infrastructure that includes railways, roads, highways, and everything in the National Infrastructure Pipeline. The government will also spend a significant amount on healthcare.

The National Infrastructure Pipeline (NIP), which was announced in December 2019 is the first-of-its-kind, whole-of-government exercise ever undertaken.

The NIP was launched with 6,835 projects and the project pipeline has now expanded to 7,400 projects.

Around 217 projects worth Rs. 1.10 lakh crores under some key infrastructure ministries have been completed.

The NIP is a specific target which this government is committed to achieving over the coming years. It will require a major increase in funding from both the government and the financial sector.

In this Budget, the government has proposed to take concrete steps to do this, in three ways: by creating the institutional structures, by a big thrust on monetizing assets, and by enhancing the share of capital expenditure in central and state budgets.

Financing infrastructure projects has always been a roadblock for infra as it requires long term loans. To solve this problem the government has proposed to set up a Development Financial Institution (DFI)

“A professionally managed Development Financial Institution is necessary to act as a provider, enabler, and catalyst for infrastructure financing. I have provided a sum of Rs. 20,000 crores to capitalize on this institution. The ambition is to have a lending portfolio of at least Rs. 5 lakh crores for this DFI in three years’ time,” Nirmala Sitharaman said in her budget speech.

Coming to healthcare, the government has proposed a new centrally sponsored scheme, PM AtmaNirbhar Swasth Bharat Yojana, that will be launched with an outlay of about Rs. 64,180 crores over 6 years.

This will develop capacities of primary, secondary, and tertiary care health systems, strengthen existing national institutions and create new institutions, to cater to the detection and cure of new and emerging diseases. This will be in addition to the National Health Mission.

To strengthen nutritional content, delivery, outreach, and outcome, the government has proposed to merge the Supplementary Nutrition Programme and the Poshan Abhiyan and launch the Mission Poshan 2.0.

The government said it will also launch Jal Jeevan Mission (Urban) that aims at a universal water supply to all 4,378 Urban Local Bodies with 2.86 crore household tap connections. This will be implemented over 5 years, with an outlay of Rs. 2,87,000 crores.

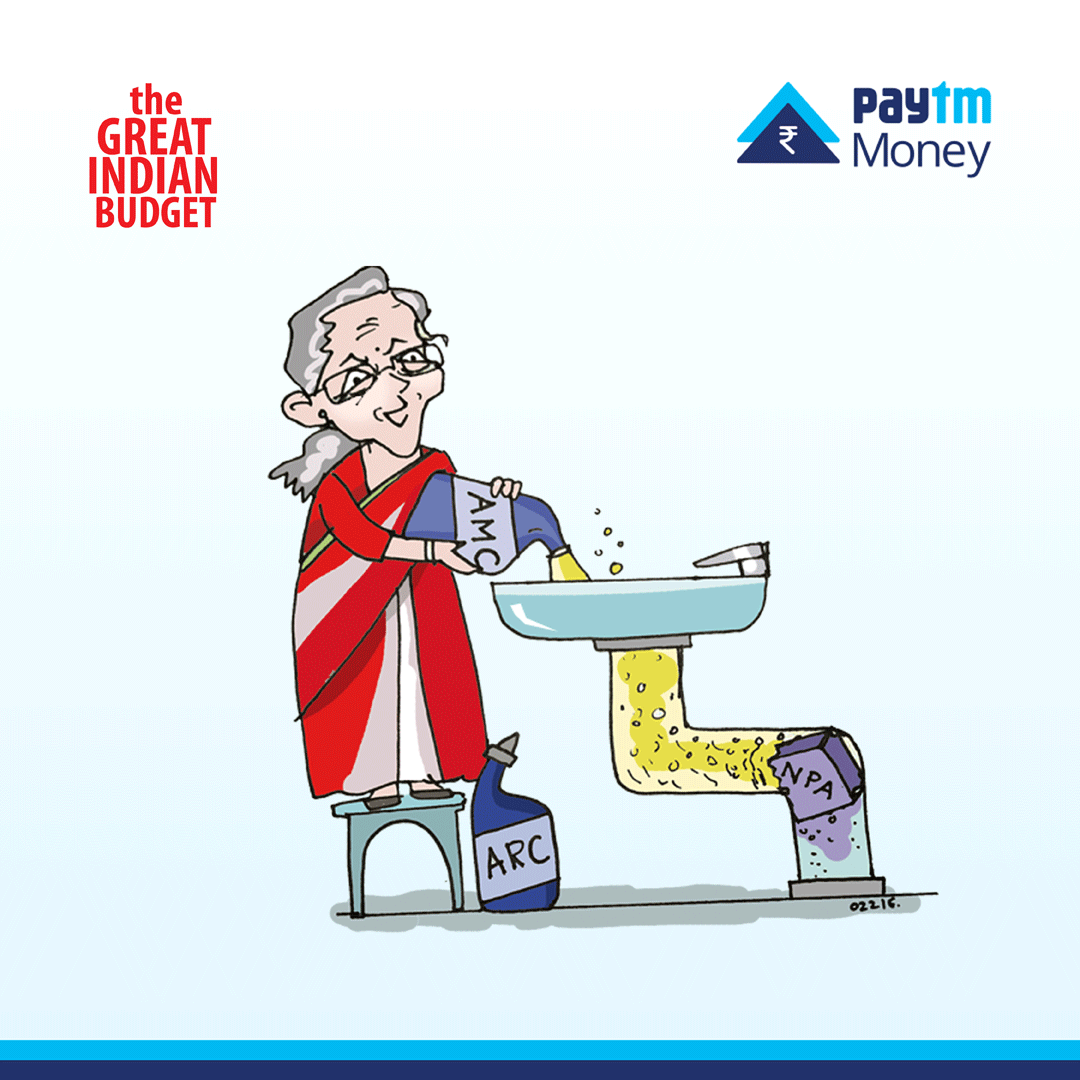

Credit Revamp

The high level of provisioning by public sector banks of their stressed assets calls for measures to clean up the bank books.

An Asset Reconstruction Company and Asset Management Company would be set up to consolidate and take over the existing stressed debt and then manage and dispose of the assets to Alternate Investment Funds and other potential investors for eventual value realization.

To further improve the financial capacity of PSBs, a recapitalization of Rs. 20,000 crores are proposed in 2021-22.

Govt’s Sources of Revenue

The government has largely maintained the status quo in its major source of revenue, i.e direct and indirect taxes, in the budget that was tabled on Feb 1. Therefore, it has turned to divestment, privatizations as its options for raising funds for robust Capex plans.

Sitharaman said that CPSEs in all but four sectors will be eventually privatized. That means the government will be a stakeholder in just 4 strategic sectors and the rest will be privatized.

It was also announced that the IPO of LIC will be brought in the coming financial year.

Two public sector banks and one general insurance company could be privatised during the coming financial year, it has been announced. There was also pre-budget talk of a revised disinvestment target to shore up revenues.

The plan involved privatising several companies in the energy, mining, and banking, apart from selling a minority stake in large entities like LIC.

“A number of transactions namely BPCL, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans, Neelachal Ispat Nigam limited among others would be completed in 2021-22. Other than IDBI Bank, we propose to take up the privatization of two Public Sector Banks and one General Insurance company in the year 2021-22,” Sitharaman said.

Debt Financing of InVITs and REITs by Foreign Portfolio Investors will be enabled by making suitable amendments to the relevant legislation. This will further ease access of finance to InVITS and REITs, thus augmenting funds for the infrastructure and real estate sectors.

The government said the non-core assets largely consisted of surplus land with Government Ministries/Departments and Public Sector Enterprises.

Monetization of land can either be by way of direct sale or concession or by similar means. This requires special abilities and hence for this purpose the government has proposed to use a Special Purpose Vehicle in the form of a company that would carry out this activity.

Other Important Announcements

Insurance

The Finance Minister proposed to increase the FDI limit in insurance companies from 49% to 74% while allowing foreign ownership and control with safeguards.

Under the new structure, the majority of Directors on the Board and key management persons would be resident Indians, with at least 50% of Directors being Independent Directors, and a specified percentage of profits being retained as a general reserve.

ULIPs or Unit Linked Insurance Plans

The Finance Minister has proposed limiting exemptions on proceeds from unit-linked insurance plans or ULIPs that have so far allowed large investors to receive tax-free returns.

For ULIPs taken on or after Feb. 1, 2021, the maturity proceeds of policies with an annual premium of more than Rs 2.5 lakh will be taxable on par with equity-oriented mutual fund schemes.

Individuals holding multiple ULIPs with an aggregate premium in excess of Rs 2.5 lakh will also have to pay tax on the proceeds.

In the event of the policyholder’s demise, either the sum assured or proceeds of the investments, whichever is higher, are paid out to the nominee. However, this amount paid to the nominee will continue to be tax-free.

Auto Sector

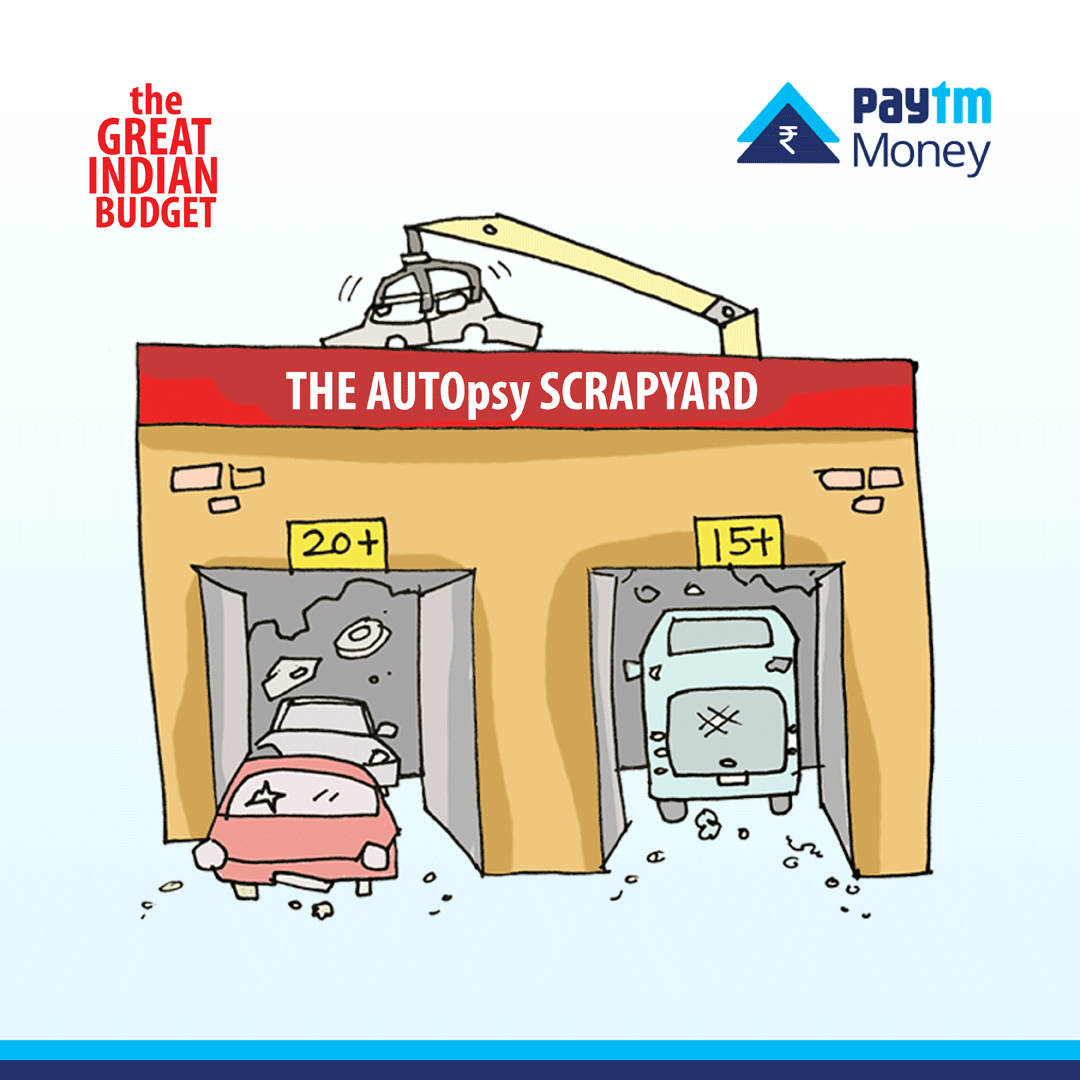

In Budget 2021, the voluntary vehicle scrapping policy was announced, to phase out old and unfit vehicles.

The scrappage policy is likely to encourage fuel-efficient, environment-friendly vehicles, thereby reducing vehicular pollution and India’s oil import bill.

Vehicles will undergo fitness tests in automated fitness centers after 20 years in the case of personal vehicles, and 15 years in the case of commercial vehicles.

Railways

Coming to Railways, the government will monetise the Dedicated Freight Corridor assets for operations and maintenance, after commissioning.

Indian Railways have prepared a National Rail Plan for India – 2030. The Plan is to create a ‘future-ready’ Railway system by 2030.

The Finance Minister is providing a record sum of Rs. 1,10,055 crores, for Railways of which Rs. 1,07,100 crores is for capital expenditure.

Farm Focused

The MSP or Minimum Support Price regime of government has undergone changes and the Finance Minister has assured a price that is at least 1.5 times the cost of production across all commodities.

“The procurement has also continued to increase at a steady pace. This has resulted in an increase in payment to farmers substantially,” Sitharaman said in her Budget speech.

To provide adequate credit to farmers, the agricultural credit target has been enhanced to Rs. 16.5 lakh crores in FY22.

Boost for Start-Ups

As a further measure that directly benefits Startups and Innovators, the government has taken steps to incentivize the incorporation of One Person Companies (OPCs).

The government plans to do so by allowing OPCs to grow without any restrictions on paid-up capital and turnover, allowing their conversion into any other type of company at any time, reducing the residency limit for an Indian citizen to set up an OPC from 182 days to 120 days and also allowing Non-Resident Indians (NRIs) to incorporate OPCs in India.

The government said it intends to incentivize start-ups in the country and has proposed to extend the eligibility for claiming tax holidays for start-ups by one more year.

Further, to incentivize funding for start-ups, the government has extended the capital gains exemption for investment in start-ups till 31st March 2022.

Changes in EPF Exemptions

In her Budget speech, the Finance Minister said that to rationalize tax exemption for the amount earned by high-income employees, it is proposed to restrict tax exemption for the interest income earned on the employees’ contribution to various provident funds to the annual contribution of Rs 2.5 lakh.

This means that if an employee’s EPF contribution is more than Rs. 2.5 lakhs a year, then the tax exemption will be restricted to the interest. At present, interest earned on provident funds is exempt from income tax.

As per the media reports, the FM while addressing a press conference said that EPFO is for the welfare of workers and workers will not be affected by this move. It is only for big-ticket money that comes into EPFO, having tax benefits and also assured 8.5% return.

Market Reaction

The stock markets have given a thumbs up to the budget, with Nifty 50 gaining nearly 5% intraday and Sensex topping over 2,000 points and ending at day’s high, up over 5%.

Not just benchmark indices but broader markets have shown their optimism as the Nifty Midcap 100& Nifty Small Cap 100 index ended over 3% & 2% higher.

Nifty Bank touched an all-time high and ended more than 8% higher post-budget, on the back of the bank recapitalization plan, proposed ARC & AMC to clean up NPAs, and overall economic revival budget.

Apart from that, the Nifty Auto index was up more than 4% on the announcement of the vehicle scrappage policy. Insurance Cos ended 1-8% higher as the government increased FDI (foreign direct investment) limit to 74%.

So how did you like our analysis of the budget? Let us know in the comments!

Source: Paytm Money